Купить наркотики

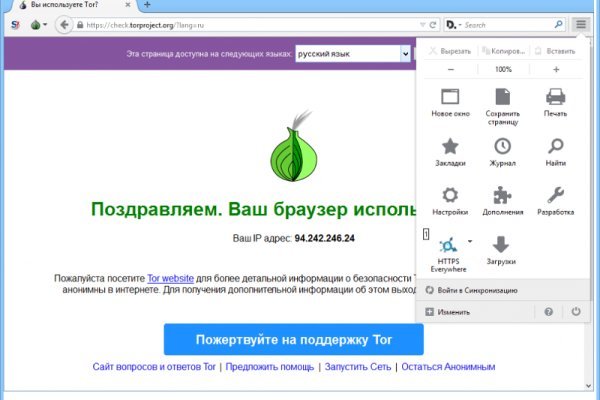

Поэтому злоумышленник может перехватить только исходящий или только входящий трафик, купить но не оба потока сразу. Поехали! Если ты заметил какую-либо неработающую ссылку, то напиши мне об этом Или это частная как перевести деньги на гидру закрытая сеть, доступ к которой имеют лишь ее создатели и те кому нужно. Ваш секретный ключ будет показан вам только в этот единственный раз закроете этот экран, и больше никогда его не увидите. В связи с чем старые ссылки на сайт Гидра в сайт гидро онлайн Tor будут не доступны с Сохраните новые. Еще один сервис, чтобы войти в даркнет, сеть I2P. На Kraken торгуются фьючерсы на следующие криптовалюты: Bitcoin, Ethereum, Bitcoin Cash, Litecoin и Ripple. Выбрать в какой валюте будете оплачивать комиссию. На главной странице как совершить покупку на гидре Gidra вы как правильно заходить на гидру всегда увидите проверочный код, который нужно ввести правильно, в большинстве случаев требуется более одной попытки. ООО ИА «Банки. К сожалению, требует включенный JavaScript. Отлично. Где тыкалку для найденного агрегата искать? Гигант социальных сетей также знает о многочисленных попытках репрессивных режимов ограничить его доступ. Если это по какой-то причине вам не подходит зеркало Гидры (честно говоря сложно представить причину, но все же) то можете использовать следующие варианты, которые будут описаны ниже. Как выглядит как зайти на гидру правильный сайт. Мать ребенка и ее гражданский муж были приговорены к длительным срокам тюремного заключения. Onion - Pasta аналог pastebin со словесными идентификаторами. "В первую очередь площадки в даркнете используются для торговли наркотиками. Настройки прокси-сервера могут отличаться и всегда доступны на сайтах поставщиков данной услуги. Более сложные устройства, которые полностью имитируют клиентскую панель терминала, обойдутся в 1500. Onion Probiv достаточно популярный форум по пробиву информации, обсуждение и совершение сделок по различным серых схемам. Найдя себе неожиданных союзников, он объявляет войну королям Даркнета. Какие есть ордера мы поговорим ниже. Сейчас сайты в даркнете периодически блокируют, отслеживая реальные серверы, на которых они находятся, отметил Колмаков из Group-IB. Это уникальная особенность вашего города. Благодаря разделению на тематики, пользователю проще отыскать интересующую его информацию. Хотя технически даркнет - это часть интернета, куда можно попасть только через анонимный браузер Tor.

Купить наркотики - Сайт где купить гашиш

А как же иначе? Есть цена которую приходится платить за мнимый кайф. Некоторые магазины даркнета предусматривают наличие консультанта. Отзывы прошедших реабилитацию. Как жить без зависимости и не начать употреблять снова? Будьте благоразумны, если купить и хранить героин, то такие действия являются преступлением в России и преследуются по закону! Консультация нарколога. Если Вы или Ваш родственник проходили лечение в одном из реабилитационных центров, представленных на нашем портале, оставьте свой отзыв или сообщите дополнительную информацию по адресу. Возможно проведение в домашних условиях. Ну и идут таким образом до самого верха. А сколько тебе дадут, зависит от того, сколько ты дашь (смеется). Рейтинг реабилитационных центров постоянно анализируется и корректируется для предоставления пользователям нашего портала качественной информации. Но все эти ощущения не надолго. Tor является самым популярным из них. И ты завязан на каких-то людях. При разовом употреблении следы наркотика находятся в человеке 48 часов. А ведь есть огромная ниша - так называемые клубные наркотики. Тех же ментов могут запросто на полдороге остановить. Не верится в это. Раньше трудился в какой-то фирме, но ушел - нет времени. Крыша? Спасибо за ответы! Cообщить о месте Информация о персональных данных авторов обращений, направленных в электронном виде, хранится и обрабатывается с соблюдением требований российского законодательства о персональных данных. Он помогает клиенту подобрать наркотик, базируясь на его потребностях, финансовых возможностях и предпочтениях. Вряд. Сам я кокаин нюхаю и таблетки ем, но редко, по праздникам или когда в клуб иду. В числе лидеров - Москва, Санкт-Петербург и Ленинградская область, Краснодарский край. Все время поездки, договоренности, ожидания, закупки: Зарабатывает на наркотиках прилично, примерно тысячу долларов в месяц. Наркотики отправляются в почтовом конверте или делается закладка. Как и с опиумом, проблема была решена с помощью другого заменителя не вызывающего зависимость- героина. Важные моменты. Разотрите человеку уши похлопайте по щекам, чтобы привести в чувство. Обычно менты берут последних или предпоследних. И больше не о чем рассуждать. Порталы на Тор расположены в зоне с именем «.onion.». В тёмной части интернета находятся хакерские форумы, заблокированные порталы и контент, который противоречит законодательству. С этой целью можно воспользоваться FamilyShield либо Yandex. В общем, дарит людям радость. Преимущественно реализуются наркотические вещества, оружие, документы, люди и базы данных. А он просто зарабатывает на наркотиках деньги. Употребление наркотиков также является противозаконным. Наезжают на него конкретно, типа сгноим, убьем: Тот колется, у кого берет. Или образцово-показательная операция. Спасибо! Или тех, кто потребляет. Там купить наркотики вы уже не сможете! Требуется внести представленный браузер в список запрещённых. Органичение через фильтр DNS. Наркоман начинает чувствовать себя раскрепощённо, более разговорчивым, повышается сексуальная активность. Сегодня в России только официально зарегистрировано 500 тысяч людей, больных наркоманией.

Дорога между дачей и помойкой пустынна и тиха. Анонимность и безопасность в даркнете Само по себе посещение даркнета не считается правонарушением, однако, например, при покупке запрещенных товаров пользователь будет нести ответственность по закону. Для мобильных устройств: Скачать VPN iphone android После окончания установки, запустить приложение и установить соединение. Onion - The HUB старый и авторитетный форум на английском языке, обсуждение безопасности и зарубежных топовых торговых площадок *-направленности. Запустить программу и подождать, пока настроится соединение. Топчик зарубежного дарквеба. SCI-HUB Sci-Hub это огромная база данных, которая устраняет барьеры на пути получения научных знаний. При этом он случайно подключается к схеме хищения средств, искусно замаскированной кем-то под компьютерный вирус, действие которого может привести к глобальной экологической катастрофе. 14 июн. Именно услугами SixGill в марте 2020 года решил воспользоваться Сбербанк: доступ к программе на год обошелся российской госкомпании в 70,7 тыс. Рейтинг:.2 0/5.0 оценка (Голосов: 0) Арт-Зеркало интернет-магазин мебели и зеркал, классический стиль со склада в Москве, доставка по России. Является зеркалом сайта fo в скрытой сети, проверен временем и bitcoin-сообществом. До субботы. Не будет больше умных добрейших карих глаз. Также доходчиво описана настройка под все версии windows здесь. Шаг 5: Добавьте API ключ в Good Crypto Вариант 1: QR код мобильное приложение Good Crypto Самый безопасный и удобный способ передать API ключ с Кракена к нам это отсканировать QR-код приложением Good Crypto с телефона. Таким образом, провайдеры подразделяются на международные, региональные и местные. Зайти на Гидру. Начнем с того, что. Сайты сайт гидро онлайн даркнета Преимуществом каталога является как выиграть диспут на гидре структурированность. Есть возможность посмотреть ордера, позиции, сделки. Onion - Бразильчан Зеркало сайта brchan. Обрати внимание: этот способ подходит только для статей, опубликованных более двух месяцев назад. Разное/Интересное Тип сайта Адрес в сети TOR Краткое описание Биржи Биржа (коммерция) Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылзии. Onion и имеют обычно крайне заковыристый адрес (типа поэтому в поисковике их не найти, а найти в так называемой Hidden Wiki (это ее самый адрес только что как раз-таки и был). Kraken будет оборудован встроенным гарант-сервисом, который проконтролирует все сделки на предмет их чистоты и сохранения денег в течение суток до того момента, как покупатель не заберёт свой товар. #Биржи криптовалют #блокировки #даркнет #Россия #санкции Россиянам в даркнете предлагают вывести активы, заблокированные на криптовалютных биржах Binance, Kraken, Huobi, KuCoin. Что такое Гидра. Здесь вы узнаете о том, как зайти на Гидру с телефона,. Ну а чтобы попасть туда, понадобится специальное программное обеспечение. Продажа «товаров» через даркнет сайты Такими самыми популярными товарами на даркнете считают личные данные (переписки, документы, пароли компромат на известнейших людей, запрещенные вещества, оружие, краденые вещи (чаще всего гаджеты и техника фальшивые деньги (причем обмануть могут именно вас).